Stories from History

You have to know where you come from to know where you are going.

Writing History together

Hauck Aufhäuser Lampe

Hauck Aufhäuser Lampe has a fascinating history full of anecdotes and great personalities. The roots of the Hauck Aufhäuser Lampe banking house go back to 1796. The merger between Hauck and Aufhäuser already dates back more than two decades. Since 2016, we have been looking to the future together with our Chinese partner and investor Fosun.

And a lot has changed since then. We have grown: organically and - among other things through the acquisition of the Luxembourg companies of Sal. Oppenheim in 2017 - also inorganically. Today, Luxembourg is our largest location. The fund business has become our flagship over the last 50 years. At the same time, we expanded our service portfolio ten years ago to include our investment banking team in Hamburg. And we also expanded our private banking with the digital distribution channel Zeedin in 2018.

Then came the most important day in our history: on 1 October 2021, the merger between Hauck & Aufhäuser and Bankhaus Lampe became official. And with that, a new common history began for both banks. That of Hauck Aufhäuser Lampe.

But as a private bank we know that it is very important to know one's roots, and in our case in three directions at once. Because our past is DNA. We are proud of it. And knowing it helps us to know what future we want to write together.

And so today we invest 5 percent of our annual gross earnings in innovation. At the same time, we are striving to position ourselves in the cryptoasset sector and are looking at RPA and AI in various places. In this way, we combine our traditional values with future topics in whose professional and social relevance we believe.

1796

Foundation of Gebhard & Hauck

On January 1, 1796, Friedrich Michael Hauck became a partner in the Platz & Gebhard exchange, commission and forwarding business, which had already existed since 1753. After Hauck's participation and the retirement of the Platz family, the business was continued by Friedrich M. Hauck and Philipp Gebhard under the name Gebhard & Hauck. The company primarily traded in wine, silk and dyestuffs. It is also recorded that Gebhard & Hauck granted a loan of 100,000 florins at 4.5 percent to the Upper Rhine District as early as 1800.

1814

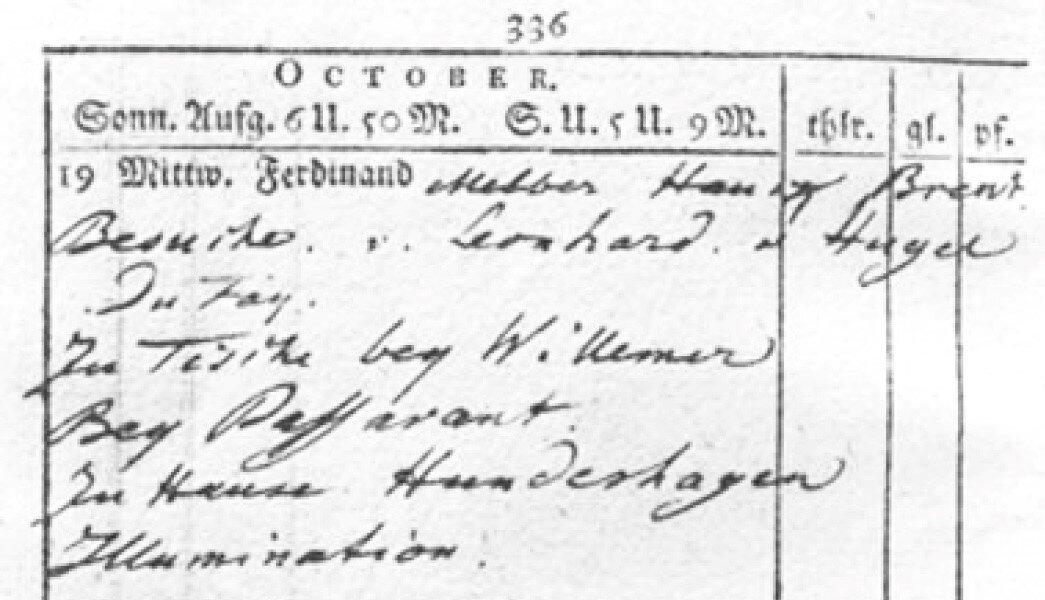

Goethe meets Hauck

Friedrich Michael Hauck is married to the daughter of the publisher Johann G. Fleischer, who published several works of the great German poet. As can be seen from Goethe's diary, he visits the Haucks, among others, in October 1814 on the occasion of his stay in Frankfurt. On the same day, the name "Hauck" is preceded in Goethe's diary by the aunt "Melber". During and after the Second World War, descendants of this aunt of Goethe are important contributors to the bank Georg Hauck & Sohn.

1815

F. M. Hauck becomes part of the first bourgeois representative system in Frankfurt

In Frankfurt, the first civic representative system develops in tentative steps. It was headed by the Senate/Council. It is assisted by the permanent citizens' representation and the newly created independent citizens' committee as a legislative assembly. The latter is also supposed to mediate between the council and the citizens' representation and to sanction state treaties. Friedrich Michael Hauck is a member of the permanent citizens' representation and is appointed to the legislative assembly.

1837

Wedding in the best company

Georg Heinrich Hauck, who later gave his name to the banking house Georg Hauck & Sohn, marries Sophie Gogel. The Gogel family belongs to a family rich in tradition. Sophie Gogel's father was taught as a youth by the philosopher Friedrich Hegel. Hegel in turn maintained close contact with Friedrich Hölderlin. The marriage shows the excellent reputation that the Hauck family built up in Frankfurt in a short time.

1839

Death of F. M. Hauck and passing on of the company to the next generation

Friedrich Michael Hauck dies in his 70th year, his wife Catharina Fleischer having died two years earlier. After his death, his two younger sons Georg Heinrich and Ferdinand Hauck take over the company.

1852

Foundation Bankhaus Lampe

On October 1, 1852 - at the beginning of the industrial age - the 24-year-old Hermann Lampe founded the company as a banking and forwarding business in Minden. With commercial skill, he developed the company - from very small beginnings - into a banking house that was able to make a good name for itself in the East Westphalian region, and Hermann Lampe's advice was soon valued everywhere.

1861

Gebhard & Hauck becomes Georg Hauck & Sohn - from now on only banking business

In 1861, the two sons of Friedrich Michael Hauck separate for business purposes. Gebhard & Hauck is transferred to Georg Hauck & Sohn. The "son" refers to Georg Hauck's offspring Alexander. From this point on, only banking business is conducted. Georg Hauck's brother founds Bank Ferdinand Hauck, which is liquidated in 1926 after a few successful years.

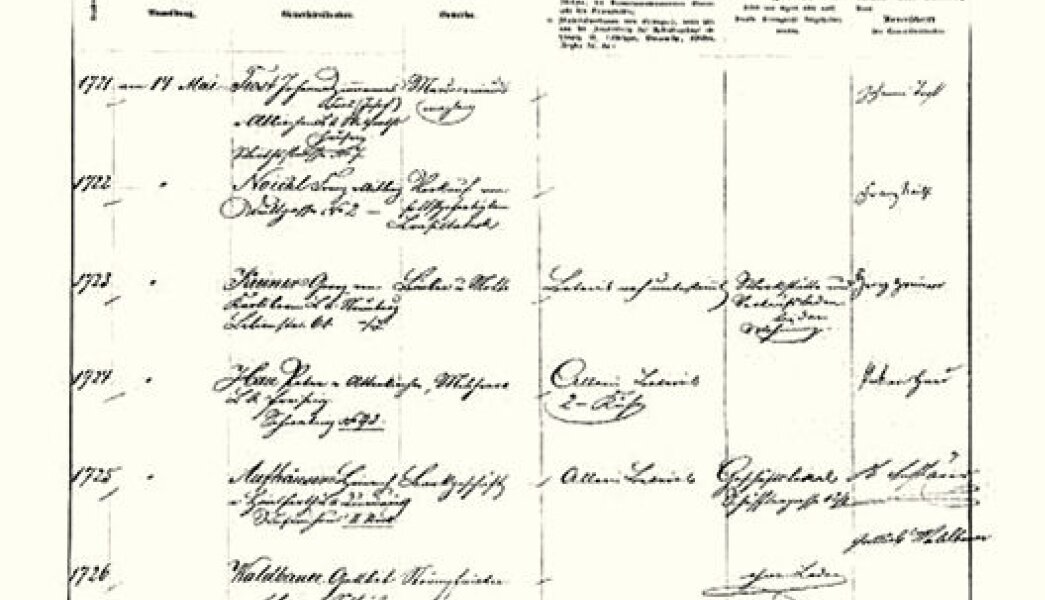

1870

Foundation of Bankhaus Aufhäuser & Scharlach in Munich

On May 14, 1870, Heinrich Aufhäuser registered the operation of a banking business with the city of Munich. In Samuel Scharlach, he finds a partner who is a merchant and leaves the management to Heinrich Aufhäuser. In 1871, the bank was already making a profit of more than 34,000 gulden. In the next three decades in particular, securities trading was the mainstay of the bank.

Contact with wealthy customers was essential for successful business in the securities sector. These customers sought a profitable capital investment through the purchase of shares or private and public bonds. To do this, they needed the advice of a trustworthy and experienced banker.

1877

Bankhaus Lampe led by Carl Siebe and Wilhelm Wegener

On July 15, 1877, Hermann Lampe suffered a fatal accident. The still small but solid bank was then taken over by one of his employees, Carl Siebe, and his cousin, Wilhelm Wegener. Under the energetic leadership of these two bankers, the company grew into a banking house that supported and promoted the economy of the Minden-Ravensberg region full of energy and dynamism: Foundations of stock corporations were accompanied, bonds were placed and the first contacts abroad were already established.

1888

Hauck takes Hoechst public | Hauck is limited partner in the formation of BBC

After Georg Hauck's death, his son Alexander took over the bank's business. In the same year, he was elected to the supervisory board of Farbwerke Hoechst. The dye factory became a globally active chemical company, whose shares were traded on the stock exchange from 1888.

When the Swiss limited partnership Brown, Boveri & Cie (BBC) was founded, Georg Hauck & Sohn was one of the limited partners. In addition, Georg Hauck & Sohn is a banking partner of the German BBC subsidiary for many years.

The fact that private bankers maintain good relations with each other is demonstrated by the marriage of Otto Hauck, son of Alexander Hauck, to Mathilde Bertha Metzler, a descendant of the long-established Metzler banking family. Otto Hauck's father-in-law was the well-known Frankfurt city councilor Albert Metzler, who was appointed to the Prussian House of Lords at the beginning of the 20th century and raised to the peerage.

1894

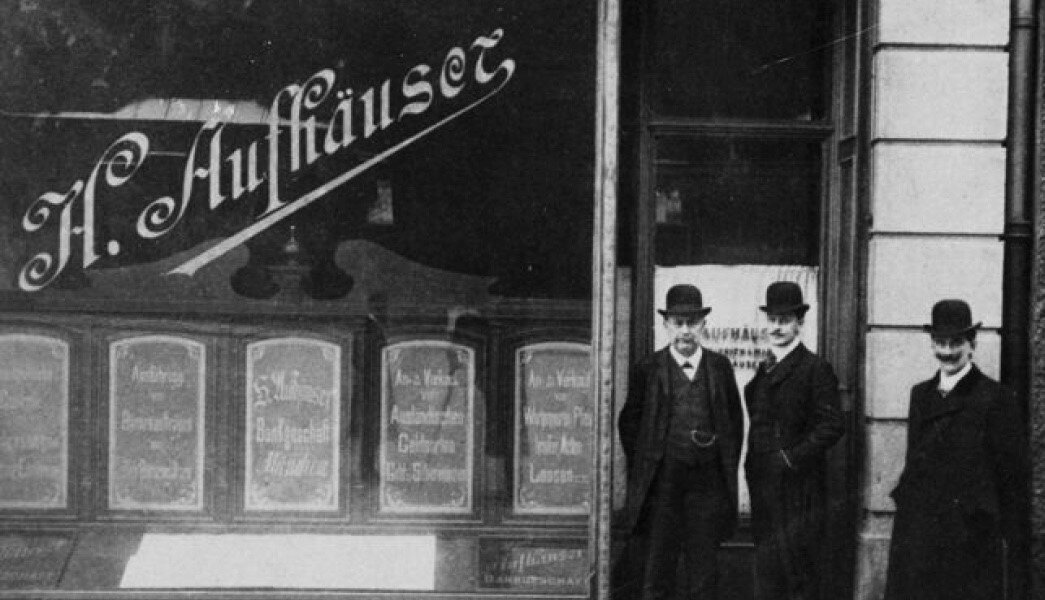

Munich-based bank changes its name to H. Aufhäuser

After Heinrich Aufhäuser paid off his former partner Scharlach, the company was renamed Bankhaus H. Aufhäuser. A short time later, there was also a new start in terms of premises: as the business was flourishing, the existing premises were no longer sufficient. Heinrich Aufhäuser buys the property at Löwengrube 20 for 160,000 marks.

1899

H. Aufhäuser expands and moves into the Löwengrube

Heinrich Aufhäuser is appointed to the board of directors of the Münchener Handelsverein, which illustrates his significant position within the city. In addition, Bankhaus H. Aufhäuser is transformed from a bank specializing in securities commission business into a high-turnover credit institution. The expansion of the business makes a move unavoidable. In the same year, the bank moves into its new premises at Löwengrube 20, which have been extensively renovated over several years.

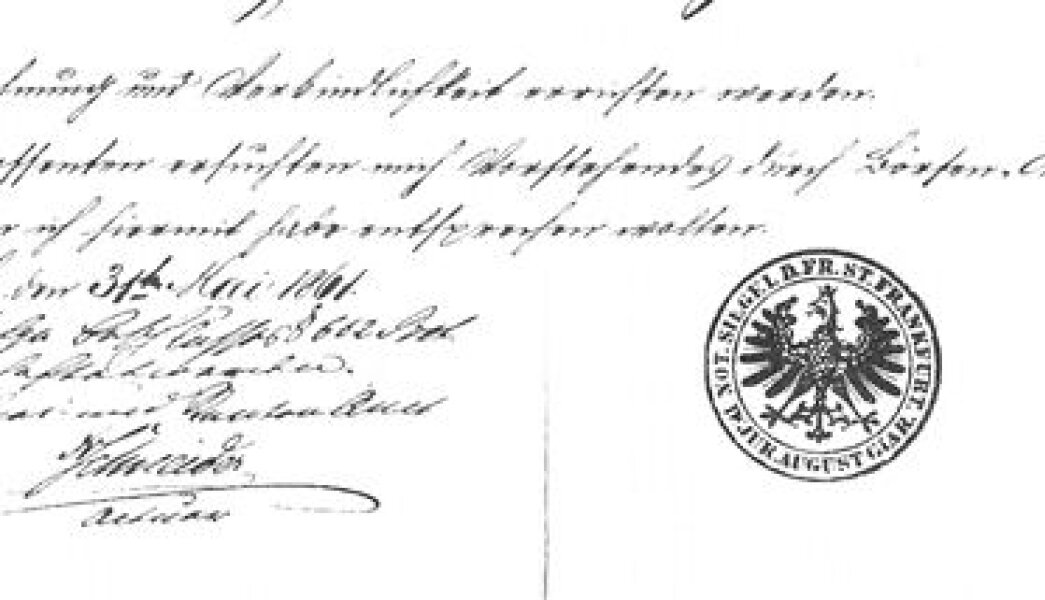

1901

M. Aufhäuser becomes a partner

Heinrich Aufhäuser takes his eldest son, 26-year-old Martin, on as a partner in the Munich-based bank. After graduating from high school, Martin Aufhäuser acquired the necessary skills for his banking career during his apprenticeship at a private bank in Frankfurt.

1905

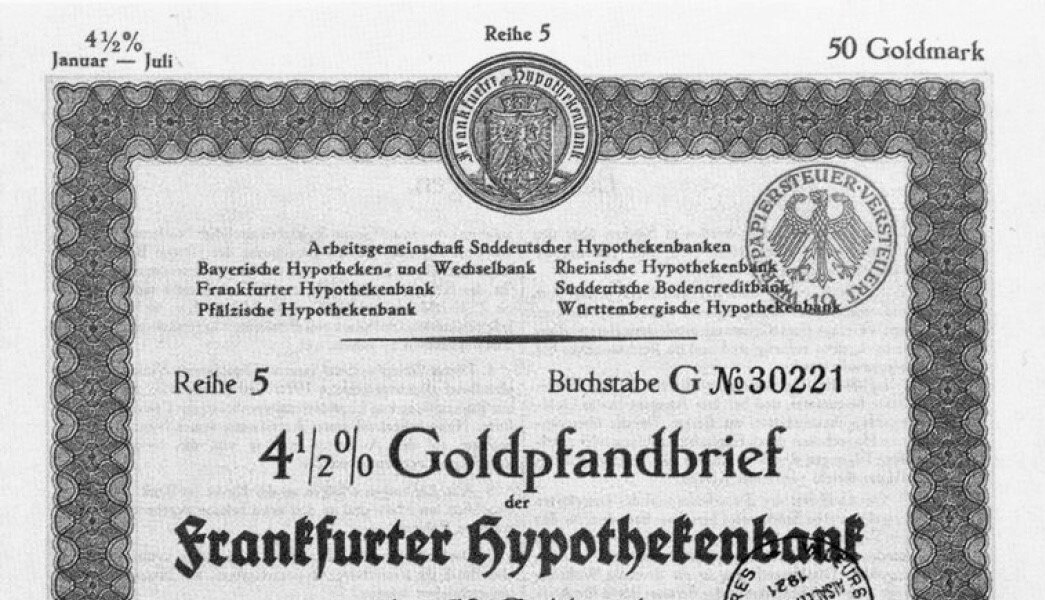

Otto Hauck on several supervisory boards | Hauck in the founding consortium of MetallBank

Otto Hauck becomes a member of the Supervisory Board of Frankfurter Hypothekenbank AG. In addition, due to his good reputation in the Frankfurt business world, he also holds supervisory board mandates of companies with which the bank does not have a close business relationship, including Deutsche Bank as well as Allianz-Versicherungen.

Georg Hauck & Sohn is a member of the founding consortium of Berg- und Metallbank, which was established by Metallgesellschaft. Alexander Hauck is also a long-standing member of the advisory board of the "Centrale für private Fürsorge," which was founded in 1899 by Wilhelm Merton, strategic head of Metallgesellschaft.

This is not the only connection between the Merton and Hauck families. Wilhelm Merton marries Emma Ladenburg, a banker's daughter, in 1877. Bank E. Ladenburg is also a member of the founding consortium of the Mining and Metal Bank in 1906. In 1968, a descendant of the Ladenburg family, Richard Ladenburg, marries Maria Hauck, a sister of Michael Hauck. Richard Ladenburg is chairman of the shareholders' committee of Georg Hauck & Sohn for ten years from 1970.

1907

Siegfried Aufhäuser: Excellent connections to London

Heinrich Aufhäuser's younger son Siegfried starts his banking career in London and obtains British citizenship. When he joined Bank H. Aufhäuser in 1921, he brought with him excellent connections to important British banks such as J. Henry Schroeder & Co, Lazard Brothers & Co. Ltd. and Coutts & Co. The latter managed the bank accounts of the royal family. Bankhaus H. Aufhäuser was given the opportunity to conduct banking business for the royals during their stays in Germany.

1913

Aufhäuser's balance sheet total exceeds 10 million

The balance sheet total of Bankhaus H. Aufhäuser exceeds the 10 million mark. Customer deposits amount to 2.4 million marks in the same period - in 1897, they were just 62,000 marks. Bank deposits increased from 88,000 to over 4 million. The bank thus became a high-turnover financial institution.

1914

H. Aufhäuser receives royal support

Heinrich Aufhäuser is awarded the title of "Königlich Bayerischer Kommerzienrat" (Royal Bavarian Councilor of Commerce) by King Ludwig III of Bavaria in "recognition of his services to the local economy. At the beginning of the 20th century, Bankhaus H. Aufhäuser's clients included prominent members of Munich society, among them the family of the writer Thomas Mann and Duke Luitpold in Bavaria.

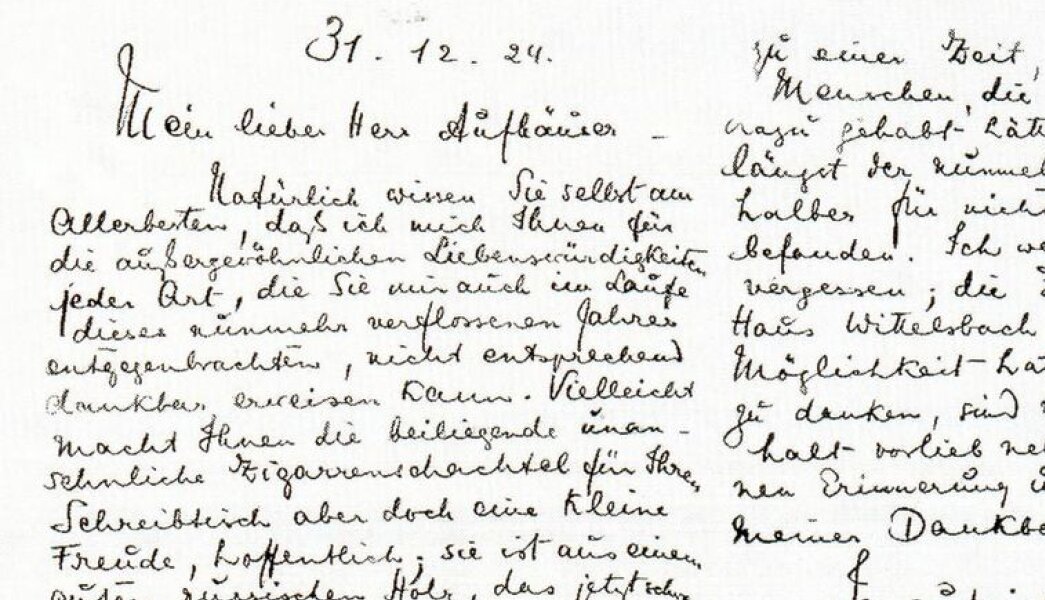

1917

Death of Heinrich Aufhäuser

After Heinrich Aufhäuser is laid to rest with great sympathy from the people of Munich, his eldest son Martin takes over the management of the bank. Three years into the war, the defeat of the German Reich becomes apparent. This is compounded by the general economic crisis and the economic blockade imposed by the Allies, as well as hunger crises among the population, which particularly affects Munich.

1917

Wilhelm Siebe and Karl Wegener become partners

In 1917, Wilhelm Siebe and Karl Wegener, the sons of the two owners, were admitted as partners. Together, they continued to run the bank in the proven manner - even after the death of their fathers. When Wilhelm Siebe died in 1938, the entire responsibility fell to Karl Wegener, who from then on managed the bank's business alone.

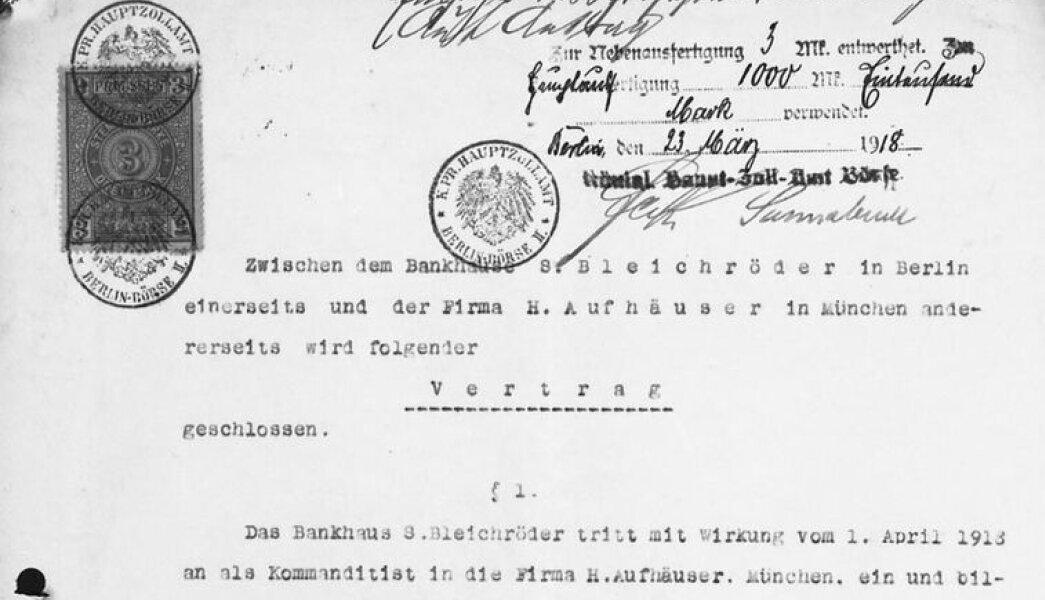

1918

Bleichröder acquires a stake in H. Aufhäuser

The renowned Berlin bank S. Bleichröder joins H. Aufhäuser as a limited partner. The Munich bank therefore changed its legal form, became a limited partnership and henceforth traded as "H. Aufhäuser Kommandite von S. Bleichröder". In 1921, Martin Aufhäuser's participation in S. Bleichröder led to a cross-shareholding between the two Jewish banking houses. Gerson Bleichröder, the founder of the Berlin banking house, is Otto von Bismarck's private banker. However, due to disputes between the heirs, S. Bleichröder's luster fades over time.

1921

O. Hauck becomes President of the Chamber of Industry and Commerce | E. Kraemer as a partner at Aufhäuser | Aufhäuser and Orbis-Film AG

After Friedrich Michael Hauck, Otto Hauck is the second of the family to become President of the (Frankfurt) Chamber of Industry and Commerce.

Siegfried Aufhäuser becomes a partner in Bankhaus H. Aufhäuser together with Emil Kraemer. Ernst Kritzler, a partner of S. Bleichröder since 1917, also joins the bank.

Munich becomes an important film metropolis. Among the major film studios are the Stuart-Webbs studios of Orbis-Film AG. When Orbis-Film AG is founded, the ordinary shares are taken over by a consortium led by Bankhaus H. Aufhäuser. In general, the financing of trade and industry increasingly becomes the focus of business activities, alongside business with wealthy private customers.

1922

S. Aufhäuser becomes "Royal Swedish Consul General"

The urbane Siegfried Aufhäuser, who is one of the prominent members of the Munich Society, is awarded the title of "Royal Swedish Consul General".

1923

Emergency money signed by O. Hauck | Extension of the lion's den

To overcome hyperinflation and regain a stable currency, emergency banknotes in gold or dollar currency are issued in Frankfurt - and signed by Otto Hauck in the first place.

The extensive remodeling and expansion work at Löwengrube 18-20 is completed. Until 2014, the premises in the immediate vicinity of the Frauendom remain the bank's Munich domicile.

1925

Hauck und Aufhäuser in the founding consortium IG Farben

Otto Hauck had been a member of the supervisory board of Farbwerke Hoechst since 1912. At the turn of the year 1925/26, the major German chemical factories merged to form IG Farben. Georg Hauck & Sohn and Bankhaus H. Aufhäuser were part of the founding consortium. Otto Hauck remained on the Supervisory Board of Hoechst until 1932, when he left, before the dark chapter of IG Farben began. In 1942, Bankhaus Georg Hauck & Sohn is forced out of the IG consortium.

1926

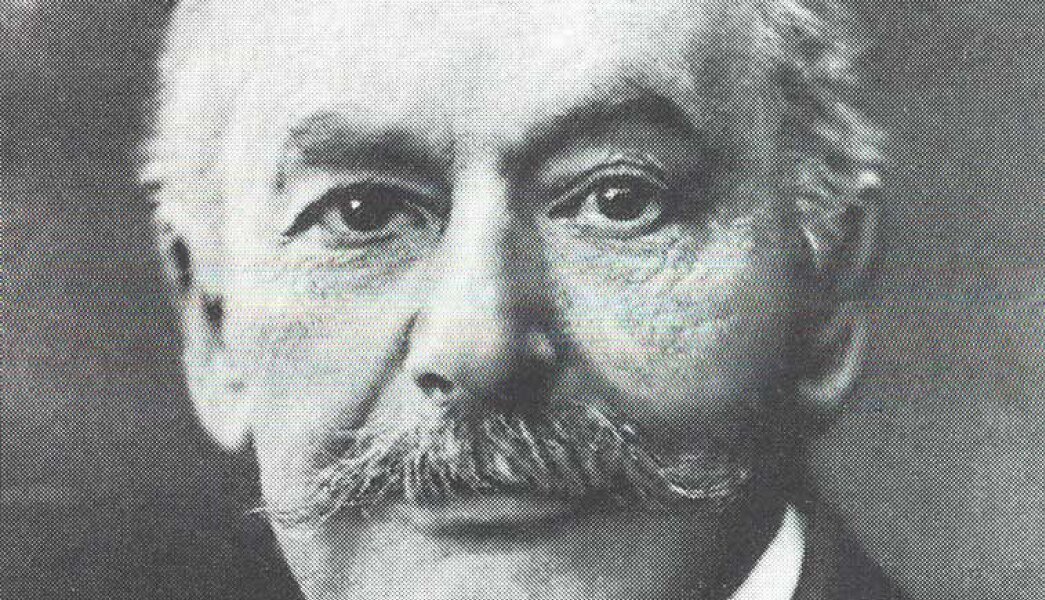

M. Aufhäuser becomes "Privy Councillor of Commerce" and member of the Board of Management of the Bavarian Stock Exchange

Martin Aufhäuser received the title of "Privy Councillor of Commerce," an honor bestowed only on the "most outstanding Bavarian managing industrialists and merchants. In the following year, he was also a member of the board of the Münchener Handelsverein and of the Bavarian Stock Exchange. Under Martin Aufhäuser's leadership, the Munich-based bank developed into one of the most renowned and largest private banks in Germany. The employees are also looked after: Martin Aufhäuser buys a large estate with a garden, which from then on serves as a popular excursion and vacation destination for the bank's employees.

1928

A pound bond for Munich; Aufhäuser and the founding of the Gemeinnützige Wohnungsfürsorge (non-profit housing association)

When the city of Munich urgently needs money for the expansion of the electricity and gas works, Bankhaus H. Aufhäuser is able to procure a bond in the amount of 1,625,000 pounds sterling from the banking house Lazard Brothers & Co. thanks to its good relations in London. In the same year, the balance sheet total of the Munich bank peaked at more than 107 million Reichsmarks.

Due to the housing shortage in Munich, Bankhaus H. Aufhäuser founds Gemeinnützige Wohnungsfürsorge AG (GEWOFAG) together with other regional institutions.

1929

M. Aufhäuser helps Hellabrunn Zoo

In order to ensure the continued existence of the Hellabrunn Zoo in Munich, the "Münchener Tierpark Hellabrunn AG" is founded. Martin Aufhäuser is involved in the foundation as a shareholder. He also becomes a member of the first supervisory board. Today, the zoo is still one of the most popular destinations in Munich.

1931

Aufhäuser provides Munich with loans in London

In the midst of the world economic crisis, Bankhaus H. Aufhäuser succeeds in obtaining short-term loans from Kleinwort, Sons & Co. in London in the amount of two million Reichsmarks for the still distressed city of Munich.

1933

O. Hauck und H. Aufhäuser suffer from "the boycott of jews"

Both the Frankfurt bank Georg Hauck & Sohn and, above all, the Munich bank H. Aufhäuser suffer under the Nazi regime. Only a few weeks after Hitler's seizure of power, the National Socialists stage the "Jewish boycott" on April 1, during which the Jewish banking house H. Aufhäuser is also blocked. On the same day, Otto Hauck is forced out of his office as president of the Frankfurt Chamber of Commerce.

1934

Death of O. Hauck and Foundation of the Employees' Support Association

Otto Hauck dies on November 25 at the age of 70. In a jubilee publication of the Chamber of Commerce on the occasion of Otto Hauck's 100th birthday, it is stated: "Otto Hauck was one of Frankfurt's most respected personalities." The number of offices he held speaks for this: among other things, he was a Frankfurt Stock Exchange board member, a member of the Reich Stock Exchange Committee, and chairman of the Frankfurt Stock Exchange Court of Honor. In addition, he held a large number of supervisory board positions. Otto Hauck's son Alexander took over the management of Georg Hauck & Sohn in 1934. In his estate, Otto Hauck decreed that 100,000 Reichsmarks be made available for the support of bank employees. As a result, the Employees' Support Association was founded. At Bankhaus H. Aufhäuser, there is a "social assistance fund" for similar cases. In 2002, the two associations merge and continue to provide support to employees and former employees of the bank as well as their dependents in the event of need for assistance, disability and old age.

1936

Loss of AR mandates

Bankhaus H. Aufhäuser has to gradually give up its supervisory board positions at other companies. Despite everything, Martin Aufhäuser can have hopes for the future of his bank. On July 16, 1936, he receives a guarantee from the Reich Ministry of Economics that "in the sense of the Reich government, dealings with the banking company are not subject to objection because of the non-Aryan character of the two owners." These assurances are unusual and show that the National Socialist regime cannot (yet) do without the Jewish banks economically - due to their economic significance as well as their good contacts abroad.

1938

"Aryanization" of Aufhäuser

In the course of the year, the situation becomes increasingly precarious for Bankhaus H. Aufhäuser due to the National Socialist repressive measures. In November, a partnership agreement is approved with the Hamburg private banker Friedrich Wilhelm Seiler, which provides for Martin Aufhäuser's participation as well as a limited partner's share. As a result of the Reich pogrom night, however, this becomes obsolete: co-owner Emil Kraemer dies and Martin Aufhäuser is taken to the Dachau concentration camp. From there, he has to conduct new negotiations for the "Aryanization" of the bank. The ten "non-Aryan" employees and the two Aufhäuser brothers have to leave, as does the participating bank S. Bleichröder. The Munich bank is renamed "Seiler & Co." after the new personally liable partner Friedrich Seiler from Hamburg.

1939

Hauck takes over majority from J. Ph. Kessler | Martin Aufhäuser in exile

Since the National Socialist regime, Alexander Hauck and his 40 employees are faced with the question of whether he must give up the banking business due to customers staying away. Through his old schoolmate Adolf Melber, who runs the J. Ph. Kessler banking house with his father, a solution presents itself. Alexander Hauck agrees with him that Georg Hauck & Sohn will take over the majority of J. Ph. Kessler; at the same time, Adolf Melber becomes a personally liable partner of Georg Hauck & Sohn. This arrangement ensures the continued existence of the bank.

In March, Martin Aufhäuser goes into exile in London with his penniless wife Auguste; in early summer, his path takes him to The Hague, and later to Amsterdam. His assets are frozen due to the anti-Jewish measures and confiscated in the course of his expatriation.

1941

Seiler fifth largest private bank

Seiler-Bank succeeds in making profits until 1944 without becoming extensively involved in Reich debt instruments and arms deals. During this period, Seiler & Co. rises to become the fifth largest German private bank. Some bank employees are drafted for military service. In order to keep in touch, the "Seiler-Heimatbriefe" inform those remaining at home about all incoming signs of life and regularly report news to those included. Meanwhile, the Gestapo regularly informs the bank that Jewish customers have "emigrated" to Theresienstadt or Auschwitz - a terrible euphemism for the transports of Jews to the places of death.

1944

Death and Destruction

Martin Aufhäuser dies in the USA at the age of 68, a broken man. Both the Frankfurt bank Georg Hauck & Sohn and the Munich bank Seiler & Co. are largely destroyed by bombing in 1944. In March, a phosphorus firebomb hits Neue Mainzer Strasse 30 and completely destroys the Frankfurt bank. A few weeks later, on the night of April 24-25, the Munich bank Seiler in Löwengrube is severely damaged. Nevertheless, business operations can be continued on a provisional basis.

1945

New beginning

For Bankhaus H. Aufhäuser, 1945 also meant continuity and a break at the same time. Because of his many years of service to the bank, Josef Bayer was appointed trustee of the bank by the U.S. military government. The first task was to rebuild the destroyed bank building in the Löwengrube.

After the end of the war, Adolf Melber was declared deposed in Frankfurt by the U.S. military government without justification. Because Alexander Hauck is already severely affected by cancer, the new start is difficult - also because the building in Neue Mainzer Strasse cannot be used after the bombing and the bank has to make do with various makeshift accommodations.

1946

Death of A. Hauck

Alexander Hauck dies in early September shortly after his son Michael returns from French captivity. Michael and his mother Anne Marie Hauck assume personal liability at Georg Hauck & Sohn. In 1946, Anne Marie Hauck's brother, Dr. August Oswalt, also becomes a personally liable partner of Georg Hauck & Sohn. He had already joined the bank in the 1930s and was instrumental in rebuilding the bank after the war.

1949

Death of S. Aufhäuser

Siegfried Aufhäuser dies in the USA. After his brother Martin had already died five years earlier, the last former Aufhäuser shareholder of the Munich-based bank is now also no longer alive.

Meanwhile, Bankhaus H. Aufhäuser (officially still Seiler & Co.) is part of the consortium that founds the first investment company in Germany, the Allgemeine Deutsche Investmentgesellschaft (ADIG). In the 1960s, the bank is involved in the placement of the first US investment fund in Germany.

1949

Bankhaus Lampe becomes limited partnership

Although the two world wars did not leave Bankhaus Lampe unscathed, the bank survived inflation and economic crises comparatively well. This provided the prerequisite for being able to initiate a new development after the currency reform.

On July 1, 1949, the company was converted from its previous legal form as a general partnership into a limited partnership. Banker Hugo Ratzmann, formerly of Hardy & Co., took over the management of the bank as sole general partner. Rudolf August Oetker, Bielefeld, C. A. Delius & Söhne, Bielefeld, and Reese Gesellschaft mbH, Hameln, joined as limited partners. As a result, the bank's capital base was broadened to such an extent that in the next few years it grew in importance far beyond the scope of its previous area of interest. According to the opening balance sheet, the equity capital amounted to DM 250,000 with one branch office and ten employees.

1950

Hauck becomes limited partnership

Georg Hauck & Sohn is converted into a limited partnership. The personally liable partners are Anne Marie Hauck, her son Michael Hauck, August Oswalt and Kurt Heide. Chairman of the Shareholders' Committee of Georg Hauck & Sohn is Dr. Rudolf Brinckmann.

1951

Opening of Bankhaus Lampe branch office in Bielefeld

In May 1951, the opening of the newly constructed bank building on the Alter Markt in Bielefeld took place. At the same time, the company's headquarters were also moved to Bielefeld. The Minden building remained as a branch. After 100 years, on October 1, 1952, the balance sheet total was DM 54.7 million. The number of employees had grown to 53 in both houses.

1954

Official change of name back to H. Aufhäuser

As compensation, the heirs of the Aufhäuser brothers received a 40 percent share in the limited liability capital of the bank, retroactive to June 21, 1948. At the same time, Josef Bayer became a personally liable partner. In January 1954, the bank celebrated its change of name back to "H. Aufhäuser" - Martin Aufhäuser's widow Auguste and daughter Emma were also welcomed in Munich. Shortly afterwards, however, the Aufhäuser family sells its stake in the bank due to the events of the National Socialist era. As a result, no members of the Aufhäuser family have held a stake in Bankhaus H. Aufhäuser since 1955.

1956

Hauck in the founding consortium DWS

Michael Hauck, already a general partner of Georg Hauck & Sohn since 1950, now actively joins the management. He is responsible for stock and bond trading as well as servicing institutional and private customers.

In the same year, the "Deutsche Gesellschaft für Wertpapiersparen mbH" (DWS) is founded. Georg Hauck & Sohn sits in the founding consortium of the investment company along with 13 other banks - and remains involved in the institute until the end of 2004.

1959

Bankhaus Lampe opens branch office in Münster

In 1959, the Münster branch was founded and the Düsseldorf stock exchange representative office - today's headquarters - was converted into a branch.

1960

Bankier Ratzmann and his work

On December 8, 1960, the banker Ratzmann died as a result of a serious car accident. Beyond his death, however, the bank remained marked by his work, which played a far-reaching role in the bank's future.

1961

Horst Herold becomes personally liable partner of Bankhaus Lampe

After the brief period of interim management by Dr. Carl Melien and Dr. Hans Heuer, Mr. Horst Herold became the bank's general partner as of July 1, 1961. Under his aegis, the banking business Marx & Co., Berlin, was taken over and transformed into the subsidiary Bankhaus Hermann Lampe KG & Co., Berlin (1962). However, after various deliberations about a new formation of the institute, Mr. Herold left the company on December 31, 1963.

1964

Dr. Hans Heuer and Rudolf von Ribbentrop become managing directors of Bankhaus Lampe

This marked a fundamental change in the bank's course, as the previous limited partner, Rudolf-August Oetker, became a general partner on January 1, 1964. Dr. Hans Heuer and Rudolf von Ribbentrop were appointed as managing directors. Total assets amounted to DM 286 million; 200 people were employed in 4 branch offices.

In the 1960s, branches were opened in Dortmund (1966), Halle in Westphalia (1966), Herford (1967), Gütersloh (1969) and finally Wuppertal (1971). The bank also had a presence in Frankfurt through Bank für Brau-Industrie AG, which was part of the Oetker Group's sphere of influence.

1968

Hauck Founding member of Universal

Georg Hauck & Sohn is a founding member of Universal-Investment-Gesellschaft mbH. From the end of 1970, Bankhaus H. Aufhäuser also acquired shares in Universal.

Practically parallel to investment savings, securities analysis developed into an independent discipline in Germany. Bank Georg Hauck & Sohn did pioneering work in this field when Axel Schütz and Michael Hauck developed the "Hauck'sche Formel" (Hauck's formula), thus making it possible to calculate tax expenses from profits.

1968

Bankhaus Erich Sültz becomes the Hamburg branch office of Bankhaus Lampe

In 1968, the takeover of Bankhaus Erich Sültz and transformation into the Hamburg branch took place.

1969

Hauck changes shareholder structure

Frank Heide, son of former partner Kurt Heide, and Axel Schütz, who makes it from apprentice to partner, join Georg Hauck & Sohn - alongside Michael Hauck and Reinhard C. Schroeder - as personally liable partners. In addition, Allianz Lebensversicherung AG becomes a limited partner.

1970

Hauck in Kaiserstraße | H. Aufhäuser opens branch office in Frankfurt

Bankhaus Georg Hauck & Sohn moves from Neue Mainzer Strasse to Kaiserstraße 24 in Frankfurt, where the bank is still headquartered today.

Exactly 100 years after its foundation in 1870, the Munich-based Bankhaus H. Aufhäuser opens a branch in Frankfurt am Main. In the anniversary year, the balance sheet total is 312 million marks and customer deposits amount to 220 million marks.

1972

R. Bayer President of the Bavarian Stock Exchange

After Josef Bayer had already been President of the Bavarian Stock Exchange for many years after the war, his son Rudolf was also appointed to this office.

1972

Mr. von Ribbentrop becomes Spokesman of the Executive Board

On December 31, 1972, Mr. von Ribbentrop was appointed spokesman of the management board and the balance sheet total exceeded the billion mark for the first time. At the same time, the number of employees reached a temporary peak at 377, as did the number of operating sites at 10.

1973

Georg Hauck & Sohn in Luxembourg

Georg Hauck & Sohn is the second German private bank to establish a subsidiary in Luxembourg: Hauck Banquiers Luxembourg S.A. This is primarily aimed at holders of foreign assets.

1974

Bankhaus Lampe leverages refinancing power

On January 1, 1974, the then Deutsche Genossenschaftskasse, now DZ BANK, acquired a nested shareholding as a limited partner in Bankhaus Lampe. This partnership enabled Bankhaus Lampe to leverage the funding power of the leading cooperative institution.

The Dortmund, Gütersloh, Herford, Minden, Halle/Westphalia and Wuppertal branches were closed in 1974/75.

1978

Conversion of Bankhaus Lampe subsidiary into Berlin branch office

On January 1, 1978, the subsidiary in Berlin was converted into a branch. Total assets exceeded the DM 2 billion mark at the end of 1978. Capital and reserves amounted to DM 79 million.

1979

Leasing and forfaiting transactions

Bankhaus H. Aufhäuser recognized the opportunities offered by the leasing business at an early stage and acquired a majority stake in BAV-Leasing GmbH in 1979. With the beginning thaw between East and West, the Munich-based bank also turned to cooperation with the national and foreign trade banks of the Eastern bloc countries in the 1970s. A wide range of forfaiting transactions were handled for Hungary, Bulgaria and Poland.

1979

Lampebank International S.A. in Luxembourg commences operations as a subsidiary of the Bank

In May 1979, Lampebank International S.A. in Luxembourg commenced operations as a subsidiary of the bank. Direct access to the expanding Euromarkets gave a further boost to the bank's development - since 1980 under the leadership of Dr. Helmut Nieland as Spokesman of the Management Board.

1980

Hauck becomes a partnership limited by shares

In 1980, Georg Hauck & Sohn is converted into a partnership limited by shares (KGaA). In addition to Allianz, Wüstenrot Lebensversicherungs AG, Crestwood GmbH and Bayernwerk AG are added as institutional limited shareholders in the course of the following years. After Dr. Rudolf Brinckmann and Richard Ladenburg, Dr. Heinrich Irmler became Chairman of the Supervisory Board in 1980. He had previously been a long-standing member of the Board of Directors of Deutsche Bundesbank.

1986

Michael Hauck Stock Exchange Board

Having already sat on the Management Board of the Frankfurt Stock Exchange for several years, Michael Hauck is now appointed Chairman. Among other things, his time included the handover of the famous "Bull and Bear" sculptures on the Stock Exchange Square. After his resignation in the summer of 1989, market observers stated that Michael Hauck's chairmanship had contributed to a new self-image of the Frankfurt Stock Exchange, making it the leading stock exchange in the Federal Republic.

1987

Opening of the Bankhaus Lampe branch in Frankfurt

In October 1987, the bank opened a branch in Frankfurt, giving it a direct presence in the center of Germany's most important financial center. With its focus on securities business and asset management, the bank is thus responding to the developments on the capital markets, which are characterized by a large number of financial innovations.

1989

BayernLB becomes sole shareholder of H. Aufhäuser

In Luxembourg, as a subsidiary of Hauck Banquiers Luxembourg S.A.. (from 1998 Hauck & Aufhäuser Banquiers Luxembourg S.A.), Hauck Investment Management Gesellschaft S.A. (from 1998 Hauck & Aufhäuser Investment Gesellschaft S.A., from 2018 Hauck & Aufhäuser Fund Services S.A.) is founded. As an investment company, it offers financial services providers the opportunity to launch investment funds under their own label.

1990

Repurchase of the 25% stake in DG Bank by the Oetker Group

On July 1, 1990, DG BANK's 25% stake was reacquired by the Oetker Group. While other private banks increasingly came under the influence of financial service providers or became subsidiaries of large banks, Bankhaus Lampe is thus one of the few classic private banking houses. As a universal bank with national and international operations and a balanced share of on-balance-sheet lending and deposit business on the one hand and service business on the other, Bankhaus Lampe was able to master even difficult banking years such as 1987 with its stock market crash.

1991

Foundation HACF

The management of Georg Hauck & Sohn founds Hauck ConsultGmbH (renamed Hauck & Aufhäuser Corporate Finance GmbH after the merger). The company is mainly concerned with advising on M&A transactions and primarily targets medium-sized companies. In 2010, the company was merged into Fides Kapital Gesellschaft für Kapitalbeteiligungen mbH.

1992

Review of financial services activities of the Oetker Group

Under Christian Graf von Bassewitz, who was appointed bank spokesman in May 1992, the Oetker Group's financial services activities were reviewed with a view to synergy effects and reorganized in order to maintain a leading position among all banks. However, the intended closer cooperation with Frankfurter Bankgesellschaft gegr. 1899 Aktiengesellschaft, which had emerged from Bank für Brau-Industrie, did not focus solely on technical issues. Rather, the personal integrity of professionally qualified employees was recognized as the essential key to the market. Bankhaus Lampe therefore set itself the goal - despite the size it had achieved in the meantime - of always remaining true to its inner location.

1993

Last Hauck drops out

Since the departure of Michael Hauck as personally liable partner, for the first time in the almost 200-year history of the bank, no member of the Hauck family is represented on the bank's management board. Michael Hauck also left the bank as a shareholder in the course of the merger.

1998

Merger to Hauck & Aufhäuser

On January 1, the Frankfurt-based bank Georg Hauck & Sohn and the Munich-based bank H. Aufhäuser merge to form Hauck & Aufhäuser Privatbankiers KGaA. The first meeting of senior executives took place in 1997 in Feuchtwangen, midway between the two locations. In the course of the merger, Allianz-Versicherungs AG, a former shareholder, left the company a short time later. The share of Bayerische Landesbank as the practical sole shareholder of H. Aufhäuser is reduced to 10 percent. The personally liable partners of the merged banking institution are Prof. Dr. Jörg-E. Cramer and Peter Gatti as well as Helmut Schreyer and Dr. Alfred Junker.

1998

Opening of Bankhaus Lampe branch office in Munich

As part of a selective growth strategy, "Frankfurter Bankgesellschaft gegr. 1899 AG," which had emerged from the Bank für Brau-Industrie, was transformed into the existing Frankfurt branch of Bankhaus Lampe to strengthen its presence in Germany's most important financial and stock exchange center. A branch was also opened in Munich that year.

2001

Shares in Bastei Privatfinanz AG

As of October 31, Hauck & Aufhäuser Privatbankiers acquires the shares in Bastei Privatfinanz AG and thus becomes the sole shareholder. The Swiss subsidiary, which has been based in Zurich since 1995, advises and serves an international clientele, particularly in the area of financial consulting. In November 2010, the company merges with Dr. Höller Vermögensverwaltung AG to form Hauck & Aufhäuser (Schweiz) AG.

2001

Foundation Lampe Asset Management GmbH

Lampe Asset Management GmbH is founded as a subsidiary of the bank in Düsseldorf. Today, Lampe Asset Management is also represented in Frankfurt with its second location.

2006

Foundation of HAAM | Hauck & Aufhäuser in Düsseldorf

In order to expand the core business area of asset management, the wholly owned subsidiary Hauck & Aufhäuser Asset Management GmbH is founded. It is headquartered in Munich and focuses on advising and managing special fund mandates for institutional clients as well as managing its own public funds and for third-party fund initiators. In 2014, this activity will be integrated into the bank and the company will be dissolved.

In addition, Hauck & Aufhäuser opens a representative office in Düsseldorf, which is expanded into a branch in 2009.

2007

Hauck & Aufhäuser in Hamburg

On April 22, the Honorary Chairman of Hauck & Aufhäuser, Michael Hauck, celebrates his 80th birthday with great participation from business and politics.

Hauck & Aufhäuser opens a branch in Hamburg at the end of October - another step the bank takes towards regional expansion.

2008

Hauck & Aufhäuser Kulturstiftung established

With the establishment of the Hauck & Aufhäuser Cultural Foundation, the bank is continuing its traditional commitment of over two hundred years. In particular, the foundation honors extraordinary achievements in the fields of art, music and literature as well as science and education.

2007/2008

New Bankhaus Lampe branches

In 2007 and 2008, the company opened branches in Bonn, Stuttgart and Osnabrück and acquired a stake in DALE Investment Advisors GmbH, Vienna, in Austria.

2009

Acquisition of Dr. Höller Vermögensverwaltung | Michael Bentlage joins partner group

Hauck & Aufhäuser acquires all shares in Dr. Höller Vermögensverwaltung AG. Founded in 1982, the Swiss company is one of Europe's most renowned asset managers with an ethical-ecological focus. In November 2010, the company merges with Bastei Privatfinanz AG to form Hauck & Aufhäuser (Schweiz) AG.

Michael Bentlage joins the partner circle of Hauck & Aufhäuser as a non-liable partner.

2010

Hauck & Aufhäuser completely privately owned | Jochen Lucht joins the partner group | Hauck & Aufhäuser in Paris

Following the departure of the last institutional shareholder, WWK Lebensversicherung aG, Hauck & Aufhäuser is 100 percent privately owned. Shareholders are private individuals and entrepreneurial families.

Jochen Lucht joins the group of partners as a non-liable partner. From 2011, he is a personally liable partner.

With the expansion of its equity sales, Hauck & Aufhäuser has been serving French institutional investors from a newly opened office in Paris since October 2010.

2011

Hauck & Aufhäuser in Cologne-Bonn and London | Wolfang Deml Chairman of the Supervisory Board

A branch office will be opened in Cologne at the beginning of the year. The geographical focus of the new location is the southern part of North Rhine-Westphalia.

Hauck & Aufhäuser opens an office in London in May. From there, the research business with major international fund addresses is to be driven forward. In 2016, the existing representative office in London will be converted into a branch.

Wolfgang Deml succeeds Prof. Hans Tietmeyer as Chairman of the Supervisory Board. Wolfgang Deml was Chairman of the Board of Management of BayWa AG until 2008 and headed the Munich-based trading and services group for two decades.

2012

Stephan Rupprecht joins partner group

Stephan Rupprecht became a partner at Hauck & Aufhäuser in July 2012. Based in Munich, he was responsible for the core wealth management business for several years until he left the company at the end of 2017.

2012

Bankhaus Lampe Private & Corporate Banking

The Private Customers and Corporates business areas are combined. The bank's capital market business will be further expanded.

2013

Private customer business in Luxembourg transferred

As part of a strategic realignment, Hauck & Aufhäuser Banquiers Luxembourg S.A. has decided to transfer its retail banking business in Luxembourg to DZ PRIVATBANK. As a result, Hauck & Aufhäuser Banquiers Luxembourg S.A. will be transformed into a branch. Together with HAIG and HAAS, the Luxembourg branch moves to Munsbach. At the same time, Hauck & Aufhäuser further expands its fund and custodian bank business in Luxembourg.

2013

Foundation Lampe Privatinvest Management GmbH

In 2013, a further subsidiary, Lampe Privatinvest Management GmbH, was founded in Hamburg. Lampe Privatinvest provides private equity for German SMEs and accompanies companies on a long-term basis.

2014

Integration of Hauck & Aufhäuser Institutional Research AG

Hauck & Aufhäuser successfully completes the integration of Hauck & Aufhäuser Institutional Research AG (HAIR). Since 2009, HAIR has been conducting equity research and sales from its offices in Hamburg, London and Paris. Today, our Investment Banking business is represented in major European financial centers in London, Zurich, Paris, Frankfurt and Hamburg and also has a high market penetration in North America and Eastern Europe.

2015

Fosun purchase offer

In July, the internationally active Chinese investment company Fosun submits an offer to the owners of Hauck & Aufhäuser to buy the bank - a new milestone in our corporate history. The Shareholders' Committee, in which the majority of the owners are represented, accepts the purchase offer.

2016

Acquisition of Hauck & Aufhäuser by Fosun successfully completed

On September 9, the acquisition of Hauck & Aufhäuser by Fosun is successfully completed after several months of regulatory review. Fosun acquires 99.91 percent of Hauck & Aufhäuser's shares.

Back in May, Hauck & Aufhäuser takes an important step in terms of digital solutions with the acquisition of a 100 percent stake in easyfolio, one of the leading providers of investments on the Internet.

2017

Hauck & Aufhäuser is transformed from a KGaA into a stock corporation.

2018

Growth in Luxembourg | Digital Asset Management Zeedin

At the end of 2017, the successful acquisition of Sal. Oppenheim's fund platform business in Luxembourg from Deutsche Bank took place. Subsequently, in spring 2018, the management companies were transformed into Hauck & Aufhäuser Fund Services S.A..

In addition, its own digital asset management company Zeedin was launched. In addition, H&A Global Asset Management GmbH was founded, thus spinning off the bank's asset management activities.

2018

Foundation of Kapital 1852 Beratungs GmbH

Founding of Kapital 1852 Beratungs GmbH as a subsidiary in Düsseldorf and as a central and focused platform whose offering includes private equity, venture capital, real estate and private debt.

2019

Foundation Hauck & Aufhäuser Innovative Capital

The bank establishes Hauck & Aufhäuser Innovative Capital, a registered KVG for crypto and digital assets, and launches HAIC Digital Asset Fund I.

In addition, Hauck & Aufhäuser acquires a majority stake in Crossroads Capital Management Limited in Ireland.

2019

New opening of the Bankhaus Lampe branch in Bielefeld

In November, the bank will reopen in Bielefeld at the Alter Markt after a five-year core renovation. Behind the familiar monument facade, an infrastructure was created that combines the traditional business of a private bank with contemporary impulses. The construction work was delayed by archaeological discoveries: under the bank's foundation, archaeologists found not only medieval shards and vessels, but also traces left there by people as far back as 600 to 800 years before Christ.

2020

Hauck & Aufhäuser announces its intention to acquire Bankhaus Lampe.

2020

Agreement between Hauck & Aufhäuser and the Oetker Group on the acquisition of Bankhaus Lampe

On March 05, 2020, Hauck & Aufhäuser reaches an agreement with the Oetker Group to acquire Bankhaus Lampe. The merger creates one of Germany's leading private banks with a strong market position in the four core business areas of private banking, asset management, asset servicing and investment banking.

2021

Acquisition Kapilendo Custodian AG | Announcement Merger to Hauck Aufhäuser Lampe

Hauck & Aufhäuser acquires Kapilendo Custodian AG, one of the first crypto custodians with permission to hold crypto assets in Germany.

In October 2021, the approval for the acquisition of Bankhaus Lampe by Hauck & Aufhäuser will then be granted. The newly formed company will operate as Hauck Aufhäuser Lampe in the future, forming one of the largest leading private banks in Germany.

2022

Hauck & Aufhäuser and Bankhaus Lampe become Hauck Aufhäuser Lampe

We are very pleased to start the new year with a very positive message for us: The merger of Hauck & Aufhäuser and Bankhaus Lampe will create the new bank HAUCK AUFHÄUSER LAMPE on January 1, 2022. The merger will create one of Germany's leading private banks with assets under management and administration of over 200 billion euros, total assets of over 12 billion euros and more than 1,300 employees. The new bank's growth trajectory is also reflected in the composition of its Board of Management.