Kerstin Jungmann

Head of Digital Wealth Channel Zeedin

All people who invest or invest money should be aware that they have an impact on the economy and our society.

Responsible consulting and the satisfaction of our customers are among our highest priorities. In this context, it is important to establish and further develop a basis of trust. This includes offering and recommending suitable - and, if there is interest, products with sustainability features.

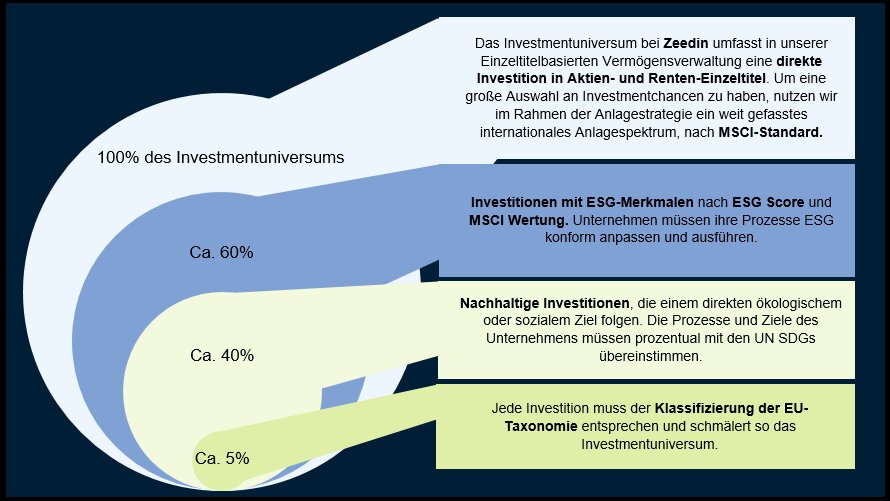

Taking sustainability preferences into account has a direct impact on the investment universe. The product range is restricted by narrow sustainability preferences and diversification opportunities are reduced.

The Markets in Financial Instruments Directive (MiFID II) came into force in January 2018. Its main objectives are to strengthen investor protection and improve the efficiency and transparency of financial markets. The EU has introduced the concept of "sustainability preferences", which will apply from 02 August 2022. With this change, a basis has been created to ensure the systematic and uniform consideration of sustainability factors in investments.

In the future, firms providing investment advisory and portfolio management services must consider the sustainability preferences of their clients in addition to their knowledge as well as their experience, financial situation and investment objectives. In this context, the question arises as to what constitutes a sustainable investment in the sense of the underlying regulatory requirements and which products are suitable for this purpose.

Taking sustainability preferences into account has a direct impact on the investment universe. The product range is restricted by narrow sustainability preferences and diversification opportunities are reduced.

Sustainability preferences in this context means the decision of a new customer as to whether and - if so - to what extent one of the following financial instruments should be included in his investment (Art. 2 No. 7 DelVO). The following categories are distinguished:

With the amendment of the MiFID II Directive as part of the implementation of the EU Action Plan Financing Sustainable Growth, the query of the sustainability preferences of new clients in investment advice and financial portfolio management is to become mandatory.

Based on your stated sustainability preferences, we check which products and investment proposals can and may be offered to you personally. For example, if you indicate that you have no sustainability preferences, you will be given a wider choice.

PAIs (Principal Adverse Impact) are sustainability factors and describe the following in German: The question is to what extent the investment objects can have a negative impact on the environment, social and employee concerns or human rights.

The Disclosure Regulation (EU 2019/2088), together with the Taxonomy Regulation (EU 2020/852), defines new standards for managing sustainability risks and negative sustainability impacts, for advertising social and environmental aspects, and for sustainable investments.

Unfortunately, we do not currently offer any so-called "Article 9 products", so it is not possible to conclude a contract in this area. If you adjust your sustainability preferences, we can in turn provide you with a suitable offer.

You still have the option of traditional investment (Art. 6 Product) if you indicate that you have no sustainability preferences in the sustainability inquiry.

With the help of independent specialists, we are constantly expanding our sustainability portfolio. We currently offer ethical asset management, a product that focuses on the topic of ESG - but it essentially consists of more than just the "Article 9 products" already mentioned.

Our monthly asset management report provides you with an evaluation of the sustainability of each product in your portfolio. You can also obtain this information from the securities' basic information sheets.

Thank you for yor request. We will contact you.

An error occurred. Check the marked fields please.

An error occurred. Check the marked fields please.

Private & Corporate Banking > Digital Wealth Management (Zeedin) > Sustainability