Overview

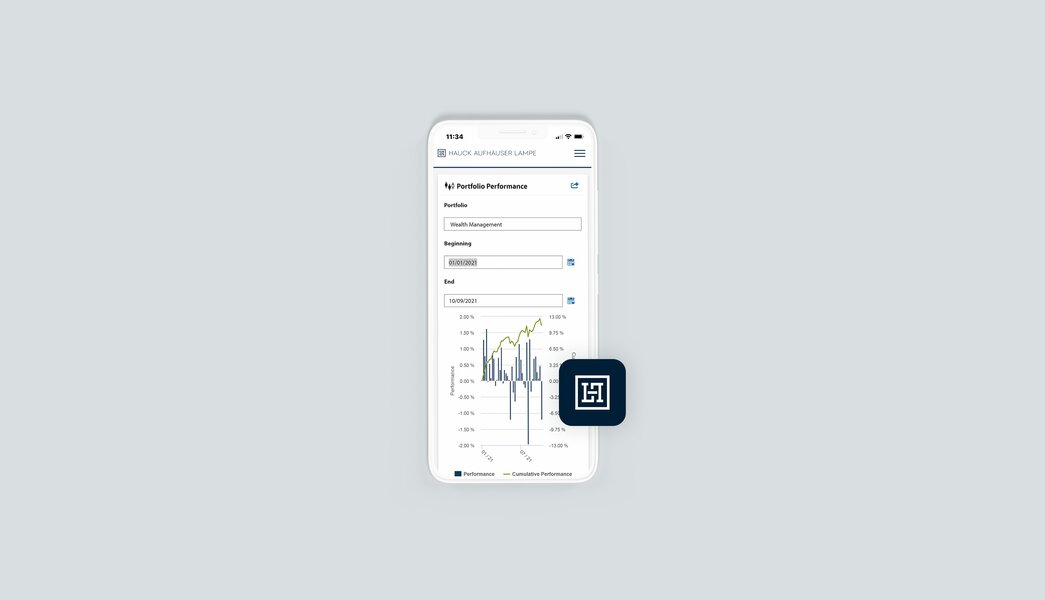

Online Banking

A warm welcome!

Comprehensive and individual service, fast and direct communication as well as maximum security - you can expect this not only in personal contact with us, but also from our online banking. Our modern online banking service offers you convenient access to your finances at any time and from anywhere, regardless of location or opening hours - via computer, tablet or smartphone. All functionalities are not only available to you as an online service, but also as a mobile app for Android and iOS. This gives you even more flexibility and independence in your financial transactions.

The main functions at a glance

Individual dashboard

Select the financial data that is particularly important to you. With your individual dashboard you can keep an eye on all important account and securities information at all times.

Portfolio evaluation

Our interactive portfolio evaluation not only analyzes your entire asset structure, but also the detailed performance of your portfolios. And with the data on historical portfolio development, you configure your personal asset reporting.

Multibanking

With our multibanking function you can also integrate accounts and securities accounts at third-party banks into your online banking. With Hauck Aufhäuser Lampe you maintain an overview at all times.

Lombard loan

You have a temporary liquidity need but do not want to access your own assets? You are welcome to complete your credit application directly via your online banking service.

Always informed

With the electronic postbox all important documents are ready to be retrieved at any time - and just one click away. The postbox replaces paper-based letter contact and enables up-to-date notifications on account development and securities account transactions.

Customer proximity

Hauck Aufhäuser Lampe is always available for you - digitally and personally, via chat or co-browsing. This enables us to provide you with prompt support and live communication for questions relating to your assets.

Comfortable and secure

Hauck Aufhäuser Lampe's modern online banking service meets highest customer demands and the latest security standards, regardless of location and opening hours - via computer, tablet and smartphone.

Securely encrypted

With our secure signature procedure we send you a personalized TAN for each order via the mobile app "H&A pushTAN". Alternatively, we also offer an SMS TAN or photoTAN procedure.

Mobile App

Our online banking is available via the mobile app "HAL mobileBanking" for Android in the Google Play Store and for iOS in the Apple App Store. It's a convenient and fast way to do banking from any device.

TAN procedure

With our secure signature procedure, we send you a personalized TAN for each order via the mobile app "HAL pushTAN". Alternatively, we also offer a SMS TAN or photoTAN procedure.

Further informationen

Service offering

Payments

- Credit transfers and direct debits (in SEPA Format)

- Template administration

- Standing orders

- Foreign payment transactions

- Online loan application

- Date transfer

Reporting

- Portfolio overview

- Portfolio structure

- Electronic asset certificate

- Dashboard widget to display portfolio performance

- Detailed view of historical portfolio performance with selection of evaluation horizon

- Detailed view of securities account development at the overall and portfolio level

Account and custody account information

- Account balance query

- Turnover query over different time periods

- Integration of third-party accounts possible (multibanking)

Custody account balance

- Portfolio value

- Initial prices

- Profit and loss

Additional features

- Personal Identification Number (PIN) management

- Personal administration of user rights

- Mailbox with personal data management

- Assigning an individual user name (alias)

Security

Protecting your assets and your banking transactions is our major priority. We have implemented state-of-the-art security procedures in our online banking to protect your accounts and transactions from unauthorized access:

- SCA - 2-factor authentification: The PSD2 policy requires logon using Stong Customer Authentication (SCA). In future, online banking customers will also have to enter a Tan (e.g. SMS Tan) after logging in with their customer number and pin in order to gain access to their online banking.

- Secure signature procedure with PushTan: For each order, we send you a personalized TAN via app to your mobile phone. In addition, you will receive all relevant order data, which you can check again before the transaction. Each TAN is issued only once and expires after 15 minutes.

- In addition, we also offer you a signature procedure via SMS TAN, in which you receive a personalized TAN via SMS on your mobile phone for each order. The SMS also contains all the relevant order data, which you can check again before the transaction. Each TAN is issued only once and expires after 15 minutes.

- Lastly, you also have the option of using our photoTAN procedure - both via our TAN app and optionally via a separate4s device. After you have entered your transfer data in online banking, a graphic appears on the screen. Using the Photo-TAN reader or the Photo-TAN app on your smartphone, you scan the graphic. This also contains all the relevant order data, which you can check again before the transaction. Here too, each TAN is only issued once and expires after 15 minutes.

- Secure data transport with 128-bit SSL encryption.

- For general questions about Hauck & Aufhäuser Online Banking, please call +49 (0) 69 2161-1112 during business hours.

Security Instructions for the Hauck & Aufhäuser Online Banking

Three steps to your Online Banking access

- Please send us a completed and signed "Agreement for Online Banking" in a sealed envelope. You can obtain the form here or from your individual relationship manager.

- You will then receive a personal welcome letter with your new online banking ID (login name and PIN) and all other user-relevant information by mail.

- When you register for the first time, you must confirm your identity once by TAN.

This feature is only available for HAL+ Users.

Get exclusive additional functions and premium content with your free account.